Prices for base and industrial and precious metals are flying high, but experts gathered at this year's BMO Global Metals and Mining Conference said we have yet to meet the new normal as the world embarks on an energy transition that represents the largest realignment of the global economy in living memory.

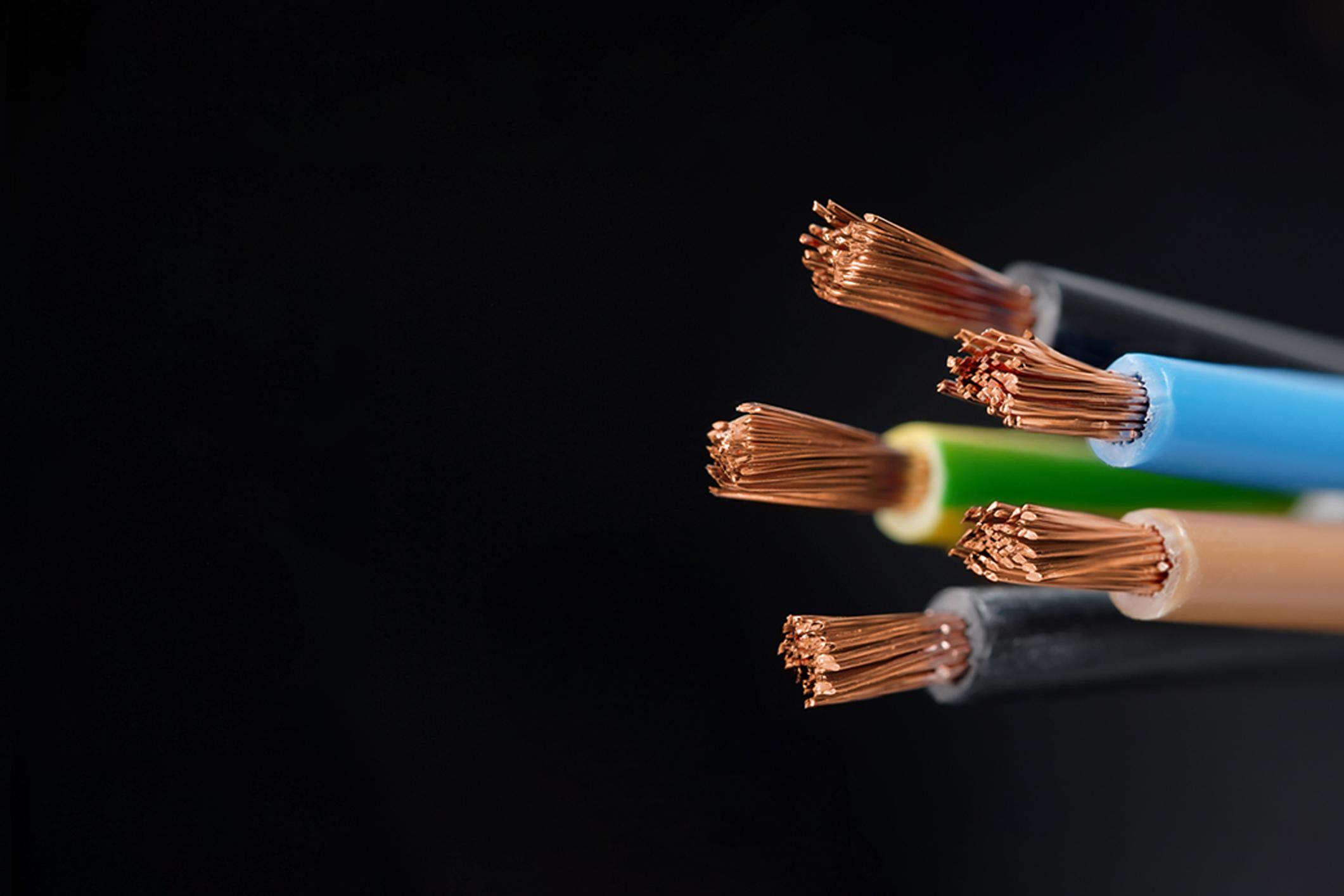

That is especially the case with copper, a key input metal for renewable energy applications - from electric vehicle batteries to solar panels to basic cabling and wiring - as we define a new energy future, panelists said.

“We have markets that are supply-constrained at the present time, and if we think about some of the themes we’ve seen in the presentations thus far, we are seeing, obviously, a good, long-term demand trend,” BMO Commodities Analyst Colin Hamilton said as he opened the Commodities and Critical Materials panel that also featured Duncan Hobbs, Research Director at Concord Resources Ltd., Andrew Cole, MD and CEO at OZ Minerals, Jeremy Weir, Executive Chairman and CEO of Trafigura Pte and Randy Smallwood, President and CEO at Wheaton Precious Metals.

On the same day that the Bloomberg Commodities Index hit its highest point since 2014, and the metals subindex hit its highest since 2011, producers, investors and metals traders said that the drivers for higher prices, from booming demand to lack of new supply, far outnumber factors that might mitigate prices, like inflation-driven demand destruction.

A Different Kind of Cycle

By all accounts, the demand cycle that has seen many metals hover at their highest in a decade is distinct from past commodities super-cycles, where demand was delimited within geographies, from reconstruction after the Second World War to systemic changes in the U.S., Japan’s industrialization and, most recently, China’s industrialization.

“What we are seeing now is basically a global change where growth is not necessarily only coming from China,” said Trafigura’s Jeremy Weir, whose multinational commodity trading company is the world’s largest private metals trader and second-largest oil trader.

“It’s coming globally via the decarbonization process. It’s all about construction, electrical grids and many other patterns in our lifestyles,” he said, noting that supply is not keeping up, despite high metals prices.

Geological Inflation and Development Challenges

With demand being so high, and projected to boom to far greater heights, the mining industry will be hard pressed to supply even the metals needed in these nascent stages of electrification and other decarbonization trends.

The issue, panelists said, lies in finding the resources and bringing them to market in an environment where shareholders are hesitant to permit mining companies the capital budgets to find and develop new deposits which in most cases won’t start producing until a decade or more, and which can often cost much more than anticipated.

“I think that is one of the reasons that many companies don’t have growth pipelines, because they don’t get the support to actually do it,” said Andrew Cole at the Australian mining company OZ Minerals. “You see it in reduced exploration spend, you see it in reduced development spend and reduced capital build spend.”

Randy Smallwood, president and CEO at Canada’s Wheaton Precious Metals, characterized the problem as “geological inflation”.

“It’s getting tougher and tougher to find the deposits, and when you find them it’s also getting tougher and tougher to actually move them forward,” he said, pointing to projects that make it through exploration and a proving out of the resource but then get turned back at the permitting stage amid community opposition.

“And so, we have this other, overriding inflation impact that is going to continue to pushing prices up higher and higher.”

Commodity Prices – Not Yet at the New Normal

Metals prices, panelists said, are and will be subjected to the opposing forces of demand on the one hand and potentially, demand destruction on the other, as consumers begin to balk at the cost of discretionary spending on goods containing metals.

When asked by panel moderator Colin Hamilton whether current prices that are well above the cost curve at the present time represent the new normal, panelists were unanimous in predicting that higher prices will prevail over the long run.

“I’m not sure we’ve hit the new normal yet,” said Weir, echoing the sentiment of his fellow panelists.

Duncan Hobbs of Concord Resources Ltd, a commodity merchant trader with a focus on non-ferrous metals and associated minerals, said that while inflation may hurt demand in the short term, longer term metals prices would benefit as investors looked to metals as an inflation hedge.

If investors in sectors like technology, for example, were to reallocate just a tiny portion of that to metals and mining investments, the impact could be significant.

“It wouldn’t take a lot,” he said. “Just a small move of assets from other markets to commodities could have a very powerful, upward impact on commodity prices in my view,” he said.

Cumulous Copper

While many metals are seen benefiting from the demand boom of the energy transition and electrification, likely the most referenced is copper, a metal that is used so much in so many applications.

“The demand for copper is real and the supply is not there, and it’s getting challenging,” said Smallwood.

“It’s one of the very few commodities that every country on the planet requires in increasing quantities, it doesn’t matter if you are industrializing or if you are trying to decarbonize,” said Cole. “I am a fundamental believer of the copper market. I think supply is incredibly challenged and it’s getting more so, and demand is only heading in one direction.”