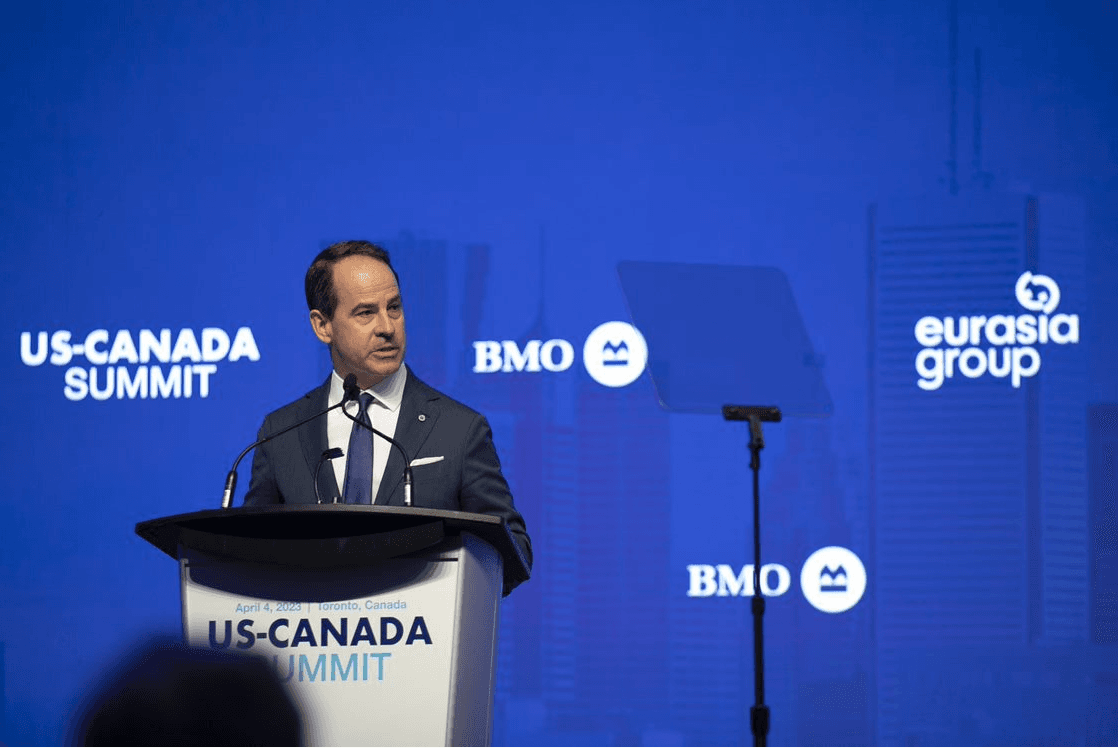

Chief Executive Officer at BMO Financial Group, Darryl White, addresses the audience at the US-Canada Summit, hosted by BMO and the geopolitical risk advisory firm Eurasia Group, to highlight the changing dynamics of trade, food, energy security, the environment (and more) in North America as the world order experiences its greatest shifts in decades.

Sustainability Leaders podcast is live on all major channels including Apple, Google and Spotify.