To do their part to meet Canada’s net-zero emissions goals, commercial real estate operators and developers are increasingly incorporating energy efficiency measures into their buildings and projects. The scope of the challenge is significant—globally, buildings and construction account for nearly 40% of carbon emissions.1 In Canada, approximately 10 million buildings can benefit from energy efficiency retrofits.2

Retrofits are retroactive improvements to building systems and fixtures designed to generate savings on utilities while simultaneously cutting carbon emissions.

Going retro

Retrofits include improvements to various energy-consuming building systems and fixtures. For example:

Upgrading from a gas-fired furnaces to heat pumps can bring huge efficiency gains. A heat pump can transfer 300% more energy than it consumes.

The installation of digital building control systems that can remotely monitor building temperature, humidity and light levels are a minimally invasive way of optimizing building performance.

Lighting upgrades can offer rapid financial payback through the replacement of incandescent lamps with LEDs, installing wireless motion sensors, or reconfiguring windows or interior spaces for better daylight harvesting.

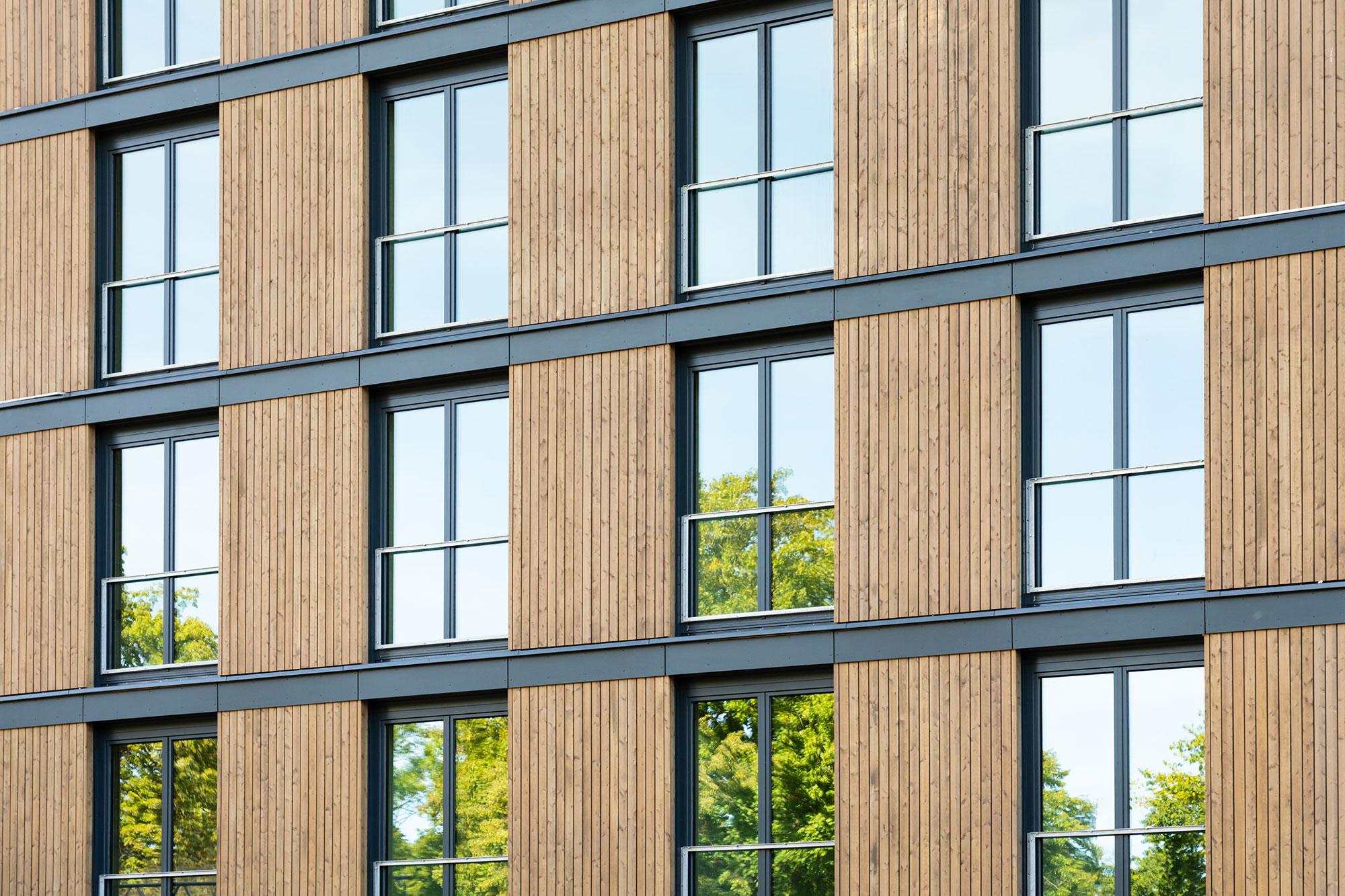

Building envelope enhancements (e.g., replacing windows and doors with energy-efficient models, adding weatherproofing, installing cladding and improved insulation) can significantly lower HVAC loading.

Betting on future benefits

When done well, energy efficiency retrofits offer a spectrum of benefits, including:

Financial

Reduced operating expenses through lower water, gas and electricity usage; reduced operation and maintenance expense with newer, more reliable equipment.

Increased revenue from higher base rental income commensurate with a better tenant value proposition (e.g., healthier environment, reduced utility bills); reduced vacancy allowance.

Capital appreciation of properties through modernization and certification, yielding higher resale value or improved cap rate.

Reduced risk to future earnings, e.g., loss of equipment value due to functional obsolescence.

ESG leadership can help attract and retain best-in-class employees, customers and tenants.

Environmental

Greenhouse gas emissions reductions, typically 20% to 60%

Reduced water usage, typically 20% to 30%.

Quality of life

More comfortable ambient temperatures and more natural daylight.

Respiratory benefits from improved air quality.

Greater resilience during blackouts or natural disasters.

Regulatory

Compliance with growing energy efficiency targets, regulations and standards, such as LEED.

Strategic positioning to minimize tax exposure—the federal carbon tax is scheduled to increase from $50 per ton in 2022 to $170 per ton in 2030.

Illustrative case studies

Industrial

The client: A design and engineering firm specializing in manufacturing and distribution of engineered protective textiles that operates out of a 52,000-square-foot facility. Key challenges included poorly sequenced and inefficient heating/cooling systems resulting in excess energy consumption; high manual workload to operate and maintain equipment; sub-optimal building comfort levels.

The retrofit: Automated 37 lighting, gas and HVAC systems, as well as electric baseboards.

The results: Financial: The cost of the project was recouped through energy savings in about five years with an internal rate of return (IRR) of 16% and a net present value (NPV) of $100,000. Environmental: Reduced greenhouse gas emissions by 56 metric tons annually.

Office

The client: A multinational defence contractor’s 312,000-square foot facility for one of its key operating divisions. The key goals for the project included lowering utility costs and greenhouse gas emissions, improving occupant comfort and reducing the building’s energy intensity.

The retrofit: Made improvements to lighting. Replaced fuel oil steam boilers with units powered by natural gas. Installed 29 wall-mounted electric setback thermostats with occupancy-sensing capability to provide separate heating settings for occupied and unoccupied conditions. Installed a boiler stack economizer to reclaim stack heat that would otherwise be lost to atmosphere. Sealed gaps in the building envelope to control air leakage.

The results: Financial: In the nine years since the retrofit, the project has achieved an annual savings of ~$450,000, a figure which exceeded the original forecasted savings. In doing so, the project achieved an NPV of nearly $730,000 with an IRR of 11%. Environmental: Over nine years, total estimated greenhouse gas savings were 2,802 tons of carbon dioxide. Savings of 1.7 million therms of natural gas, 6.5 million kWh in electricity and 1.2 million gallons of fuel oil were also achieved.

Multifamily residential

The client: A residential complex with 28 townhomes and a 123-unit tower. Many of the building’s fresh air and heating systems were close to the end of their service life and in significant need of renewal. The project aimed to reduce carbon emissions by at least 30%, realize $65,000 in annual utility savings, address deferred maintenance priorities and improve the indoor environment for residents.

The retrofit: Reduced water consumption through low-flow showerheads, faucet aerators and three-litre water closets. Replaced existing boilers with two high-efficiency models for domestic hot water and one condensing boiler for space heating. Replaced domestic cold water booster pumps with variable frequency drive-equipped models. Lowered electricity consumption from appliances by replacing original refrigerators and stoves with high-efficiency models. Installed corridor lighting with lower wattage T8 fluorescent tubes and added motion sensors in some common spaces.

The results: Financial: The retrofit project achieved nearly $93,000 in annual cost savings representing a 20% reduction in total utility costs, far exceeding the initial goal of $65,000 in annual utility savings. Environmental: The project reduced carbon emissions by 30%, or an average of 209 tonnes of carbon dioxide per year.

With retrofitting multifamily residential development being an essential component of Canada’s emission’s reduction plan, this example proves that the cost of a retrofit that can help the environment can also yield continued savings for building owners that can more than pay for the additional investment.