Why Water Access Should Be Part of Your Risk Metrics

- Courriel

-

Signet

-

Imprimer

Le contenu de cet article sera accessible en français à une date ultérieure. Restez à l’affût!

In the current tally of key risks and mitigants it’s easy to feel that the risk side of the equation is having a banner era; with business leaders being forced to manage through challenges that previous generations could have never anticipated or experienced. Climate change, populism, pandemics, high inflation, interest rate risk, economic migration, and the list goes on. Yet there is another risk that many businesses have not incorporated into their five- and 10-year strategies, and that is water risk.

While it may not appear that North America has a water shortage, a recent report by the BMO Climate Institute notes, “Holding more than 20% of the world’s freshwater reserves, North America boasts rich and diverse freshwater resources, but it is also home to some of the highest per-capita water consumption globally.”

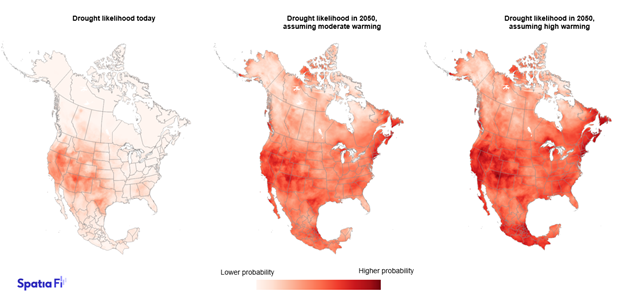

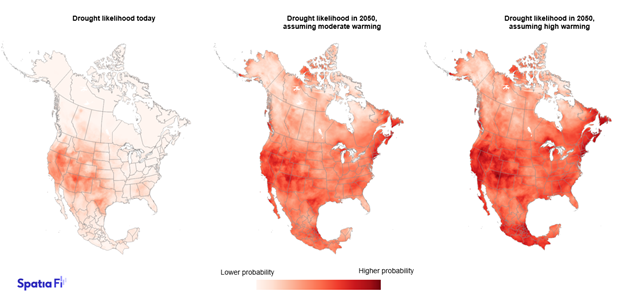

Predictability of certain events is a key element for making informed business decisions, but there’s nothing predictable about water access. Whether it’s drought conditions causing water scarcity or increased flooding inundating regions with unusable water, access to water is more imbalanced and unreliable than ever. It’s safe to say that in the next five to 10 years, your access to water will have changed compared to what it is today.

The importance of water access is obvious for some industries, such as agriculture and food and beverage. But they’re hardly the only ones. Semiconductor manufacturing, for example, is heavily dependent on access to clean water. The recent microchip shortage was due in part to a drought in Taiwan, the global impacts of which are still being felt.

“Climate change means that access to water is no longer predictable or reliable,” says Nelson Switzer, managing partner at Climate Innovation Capital, a growth equity fund focused on climate tech startups. “The cost and availability of water are having material impacts on the ability of businesses to process, procure and produce.”

Whether you’re considering regional expansion or concerned about the viability of a business model altogether, access to water should be a part of your company’s key risk metrics.

Assessing and Adjusting Your Usage and Risks

As we are seeing with ESG-related issues more broadly, for any investment horizon of more than a few years, water access will have implications on longer-term business viability. That’s why you’ll need to consider how your ability to source and access water could change in that timeframe.

Undertaking a strategic pivot starts with understanding your current water usage patterns and how that relates to the long-term water usage prognosis within your operating region. The French wine industry, for example, has had to adapt to the impact that hotter summers have had on grape production. Within 10 years, production from the Bordeaux region may not be suitable to the types of grapes they currently grow.

That’s why French winemakers are experimenting with different grape varietals that can adapt to the new conditions. It’s also why we’re seeing more winemakers expand into other Northern European countries, as well as Eastern Europe, South America and even Canada—places previously considered too cold for fine wine production—where they’ll be able to grow grape varieties that will enable them to succeed over the long term.

Another example is almond milk manufacturing. Almond trees take several years to become cash flow positive. But most North American almond production takes place in areas of California where farmers increasingly have to fallow the land—leaving it uncultivated for at least one season to allow the land to become more fertile again—because they don't have enough water to make the crops pay out.

In this case, it’s a matter of determining where you can plant almond trees that can have a useful life over the next 25 years. The solution could include considering innovations in irrigation, or it could involve adjusting your five-year plan to acquire land in a region with better access to water.

But as the availability of water is changing across North America, some tactical adjustments come with other risks. Water is crucial for the industrial and manufacturing hubs in northern Mexico, for example, but that region is currently suffering from a severe drought.

Read the full analysis from the BMO Climate Institute

You could move your operations to the more water-rich southern regions of Mexico, but that could lead to other implications. For example, would you have the supply chain infrastructure in place to handle your needs, including labor and the extra distance between your operations and your customers? That’s a question beer companies in northern Mexico are currently facing. Also, would the additional industrial demand lead to shortages down the road?

Even as we look at ways to get smarter about our own investments, vertical farming represents a significant opportunity do address many of these issues, especially in the production of leafy greens in Canada. The work being done by companies like Vision Greens in Southern Ontario demonstrates how this process can address the seasonal availability while limiting the need to ship truckloads of lettuce from California that require a significant amount of water from the Colorado river.

Capitalizing on Your Conservation Efforts

Ultimately, business owners and investors can begin to address water access by focusing on three key areas:

1. Water access should be a primary risk metric, whether you're buying, expanding or investing in a company.

2. You should understand your current reliance on water access and how that reliance will affect your future operations and profitability.

3. The time is now to determine whether you need to adjust your strategy to prepare for a potentially changing environment.

After in-depth conversations with many industry experts, including the water consultants at WaterSmart Solutions in Alberta and Water Foundry, we felt the time was now to raise these important issues with our peers.

As a business leader, it’s more important than ever to be aware of your access to water as part of your long-term plan, as well as how you position your business to potential investors. As an investor, you’ll need that information to evaluate potential opportunities. Because in the end, you can't assume that the access you have today will still be there in a few years.

“There’s not a lot we can do without water, but there’s plenty we can do with less water,” says David Henderson, Managing Partner, XPV Water Partners, a Toronto-based water investment fund. “The technology companies in our portfolio are innovators whose solutions focus on improving operational efficiencies so that end users can increasingly do more with less, meet emissions targets, and improve the quality of the water that industry returns to sustain limited freshwater supplies. A water-secure future depends on thinking differently about how we manage the water we have.”

Your workforce can be a valuable resource for tackling this issue. This is a subject that greatly concerns Generation Z, a demographic that is expected to account for 30% of the workforce by 2030. In fact, it was one of our summer interns who helped us understand the full breadth and complexity of the issue.

The risks to water access will continue to be a challenge. While the downside implications can be severe, proper planning and foresight can help you mitigate those risks.

“Access to clean and fresh water suitable for sanitation and hygiene is a fundamental human right,” Switzer says. “All people and businesses seem to agree on that. However, we must also ensure that businesses can access the quality and quantity of water they require to operate in order to ensure a stable and prosperous economy and society.”

Why Water Access Should Be Part of Your Risk Metrics

Chef, BMO Partenaires

Alex est le chef - BMO Partenaires et Fusions et acquisitions Moyennes entreprises. Il s’occupe principalement de capital-investissement, de dettes subor…

Alex est le chef - BMO Partenaires et Fusions et acquisitions Moyennes entreprises. Il s’occupe principalement de capital-investissement, de dettes subor…

VOIR LE PROFIL COMPLET-

Temps de lecture

-

Écouter

Arrêter

-

Agrandir | Réduire le texte

Le contenu de cet article sera accessible en français à une date ultérieure. Restez à l’affût!

In the current tally of key risks and mitigants it’s easy to feel that the risk side of the equation is having a banner era; with business leaders being forced to manage through challenges that previous generations could have never anticipated or experienced. Climate change, populism, pandemics, high inflation, interest rate risk, economic migration, and the list goes on. Yet there is another risk that many businesses have not incorporated into their five- and 10-year strategies, and that is water risk.

While it may not appear that North America has a water shortage, a recent report by the BMO Climate Institute notes, “Holding more than 20% of the world’s freshwater reserves, North America boasts rich and diverse freshwater resources, but it is also home to some of the highest per-capita water consumption globally.”

Predictability of certain events is a key element for making informed business decisions, but there’s nothing predictable about water access. Whether it’s drought conditions causing water scarcity or increased flooding inundating regions with unusable water, access to water is more imbalanced and unreliable than ever. It’s safe to say that in the next five to 10 years, your access to water will have changed compared to what it is today.

The importance of water access is obvious for some industries, such as agriculture and food and beverage. But they’re hardly the only ones. Semiconductor manufacturing, for example, is heavily dependent on access to clean water. The recent microchip shortage was due in part to a drought in Taiwan, the global impacts of which are still being felt.

“Climate change means that access to water is no longer predictable or reliable,” says Nelson Switzer, managing partner at Climate Innovation Capital, a growth equity fund focused on climate tech startups. “The cost and availability of water are having material impacts on the ability of businesses to process, procure and produce.”

Whether you’re considering regional expansion or concerned about the viability of a business model altogether, access to water should be a part of your company’s key risk metrics.

Assessing and Adjusting Your Usage and Risks

As we are seeing with ESG-related issues more broadly, for any investment horizon of more than a few years, water access will have implications on longer-term business viability. That’s why you’ll need to consider how your ability to source and access water could change in that timeframe.

Undertaking a strategic pivot starts with understanding your current water usage patterns and how that relates to the long-term water usage prognosis within your operating region. The French wine industry, for example, has had to adapt to the impact that hotter summers have had on grape production. Within 10 years, production from the Bordeaux region may not be suitable to the types of grapes they currently grow.

That’s why French winemakers are experimenting with different grape varietals that can adapt to the new conditions. It’s also why we’re seeing more winemakers expand into other Northern European countries, as well as Eastern Europe, South America and even Canada—places previously considered too cold for fine wine production—where they’ll be able to grow grape varieties that will enable them to succeed over the long term.

Another example is almond milk manufacturing. Almond trees take several years to become cash flow positive. But most North American almond production takes place in areas of California where farmers increasingly have to fallow the land—leaving it uncultivated for at least one season to allow the land to become more fertile again—because they don't have enough water to make the crops pay out.

In this case, it’s a matter of determining where you can plant almond trees that can have a useful life over the next 25 years. The solution could include considering innovations in irrigation, or it could involve adjusting your five-year plan to acquire land in a region with better access to water.

But as the availability of water is changing across North America, some tactical adjustments come with other risks. Water is crucial for the industrial and manufacturing hubs in northern Mexico, for example, but that region is currently suffering from a severe drought.

Read the full analysis from the BMO Climate Institute

You could move your operations to the more water-rich southern regions of Mexico, but that could lead to other implications. For example, would you have the supply chain infrastructure in place to handle your needs, including labor and the extra distance between your operations and your customers? That’s a question beer companies in northern Mexico are currently facing. Also, would the additional industrial demand lead to shortages down the road?

Even as we look at ways to get smarter about our own investments, vertical farming represents a significant opportunity do address many of these issues, especially in the production of leafy greens in Canada. The work being done by companies like Vision Greens in Southern Ontario demonstrates how this process can address the seasonal availability while limiting the need to ship truckloads of lettuce from California that require a significant amount of water from the Colorado river.

Capitalizing on Your Conservation Efforts

Ultimately, business owners and investors can begin to address water access by focusing on three key areas:

1. Water access should be a primary risk metric, whether you're buying, expanding or investing in a company.

2. You should understand your current reliance on water access and how that reliance will affect your future operations and profitability.

3. The time is now to determine whether you need to adjust your strategy to prepare for a potentially changing environment.

After in-depth conversations with many industry experts, including the water consultants at WaterSmart Solutions in Alberta and Water Foundry, we felt the time was now to raise these important issues with our peers.

As a business leader, it’s more important than ever to be aware of your access to water as part of your long-term plan, as well as how you position your business to potential investors. As an investor, you’ll need that information to evaluate potential opportunities. Because in the end, you can't assume that the access you have today will still be there in a few years.

“There’s not a lot we can do without water, but there’s plenty we can do with less water,” says David Henderson, Managing Partner, XPV Water Partners, a Toronto-based water investment fund. “The technology companies in our portfolio are innovators whose solutions focus on improving operational efficiencies so that end users can increasingly do more with less, meet emissions targets, and improve the quality of the water that industry returns to sustain limited freshwater supplies. A water-secure future depends on thinking differently about how we manage the water we have.”

Your workforce can be a valuable resource for tackling this issue. This is a subject that greatly concerns Generation Z, a demographic that is expected to account for 30% of the workforce by 2030. In fact, it was one of our summer interns who helped us understand the full breadth and complexity of the issue.

The risks to water access will continue to be a challenge. While the downside implications can be severe, proper planning and foresight can help you mitigate those risks.

“Access to clean and fresh water suitable for sanitation and hygiene is a fundamental human right,” Switzer says. “All people and businesses seem to agree on that. However, we must also ensure that businesses can access the quality and quantity of water they require to operate in order to ensure a stable and prosperous economy and society.”

Définir l'avenir

PARTIE 1

Perspectives du marché américain de Brian Belski pour 2022

Brian Belski 09 décembre 2021

Dans ses perspectives du marché américain pour 2022, le stratège en chef, Placements de BMO Marchés des capitau…

PARTIE 2

L’état actuel et futur de la chaîne d’approvisionnement mondiale

Fadi Chamoun, CFA 17 février 2022

BMO a récemment organisé une table ronde pour faciliter un débat sur les problèmes d’approvisionnement et…

PARTIE 3

Prêts liés à la durabilité : ce n’est qu’un début!

John Uhren 01 mars 2022

Le lancement, par Enbridge Inc., de son premier prêt lié à la durabilité de 1 milliard de dollars canadiens…

PARTIE 4

L’évolution de la structure de marché se poursuit malgré la pandémie

Joe Wald 01 avril 2022

Avant que la crise de la COVID-19 (virus, variants et vaccins) mobilise l’attention de tous, la Securities and Exchange Commission (&…

PARTIE 5

État de l'Union : ce qui nous attend

Brian Belski, David Jacobson, Michael Gregory, CFA 21 avril 2022

L'invasion de l'Ukraine par la Russie a fait planer l'incertitude sur la politique intérieure et étrangère…

PARTIE 6

Les prix des métaux encore loin d’une nouvelle normalité : Table ronde de BMO sur les mines

Colin Hamilton 12 mai 2022

Les prix des métaux de base, des métaux industriels et des métaux précieux s’envolent, mais les spé…

PARTIE 7

Problèmes de la chaîne d’approvisionnement : le bien-être des fournisseurs au cœur des préoccupations

Reg Butler 02 juin 2022

Les retards dans la chaîne d’approvisionnement et les maux de tête qu’ils causent aux entreprises et aux consommate…

PARTIE 8

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

Dan Barclay 26 mai 2022

Disponible en anglais seulement Join BMO’s Dan Barclay, Bert Powell, Joel Jackson, Ken Zaslow and Doug Morrow in this special epis…

PARTIE 9

Un marché des fusions et acquisitions actif, malgré le contexte macroéconomique

Warren Estey 19 mai 2022

Malgré un volume d’opérations moindre en 2022 – freiné par la volatilité des marchés, l&rsqu…

PARTIE 10

Les capitaux privés volent la vedette sur le marché intermédiaire américain

Grant Thompson 04 août 2022

Par-delà les marchés publics, il y a un nouveau venu dans le paysage - en quelque sorte. Il s’agit des capitaux priv…

PARTIE 11

Supply Chain Disruption: Key Challenges and Opportunities

Fadi Chamoun, CFA 01 septembre 2022

Disponible en anglais seulement New look, same great content! We’re proud to launch Markets Plus, our new podcast, where leading BMO exper…

PARTIE 12

Être rentable face à l’évolution accélérée de l’IA

David Wismer 19 octobre 2022

De l’amélioration de l’apprentissage automatique à la conception de nouveaux systèmes de base de donn&eacu…

PARTIE 13

Stratégie de placement nord-américaine : perspectives du marché américain 2023

Brian Belski 21 décembre 2022

Bien que 2022 soit une année que « nous préférerions oublier », 2023 devrait marquer le dé…

PARTIE 14

Gérer et monétiser votre transition vers un monde carboneutre avec BMO et Radicle

Eric Jacks 01 décembre 2022

Lorsque Radicle Group Inc. a été fondée à Calgary (Alberta) en 2008 sur le premier marché régleme…

PARTIE 15

L’importance des prévisions financières

22 février 2023

Prévoir et prédire l’avenir. C’est la même chose, n’est-ce pas? Pas vraiment. Nous faisons tous de…

PARTIE 17

Understanding the Link Between Cybersecurity and ESG

John Uhren, Andrew Matheou 02 février 2023

Disponible en anglais seulement John Uhren is joined by Andrew Matheou, Head of BMO Capital Markets Global Transaction Banking, to discuss the t…

Autre contenu intéressant

Making Renewable Energy Technology Accessible to Underserved Communities: GRID Alternatives in Conversation

Comptabilisation du carbone : Comment renforcer les plans climatiques des entreprises

Les progrès de la technologie des batteries alimentent l’optimisme au sujet de l’industrie des VE

Le coût des plans d’action des entreprises en matière de climat

Les femmes jouent un rôle de premier plan dans le domaine du climat et du développement durable

Risque climatique : changements réglementaires à surveiller en 2024

Le rôle de l’exploitation minière responsable dans la transition vers les énergies propres : entretien avec Rohitesh Dhawan, chef de la direction de l’ICMM

Comment la NASA et IBM utilisent les données géospatiales et l’intelligence artificielle pour analyser les risques climatiques

Décloisonner le développement durable pour l’intégrer aux fonctions de base

L’obligation de publier de l’information sur les facteurs ESG est le signe d’un marché arrivé à maturité

BMO organise un financement vert pour financer le nouveau Lawson Centre for Sustainability, la construction la plus importante de Trinity College depuis un siècle

BMO se classe parmi les sociétés les plus durables d'Amérique du Nord selon les indices de durabilité Dow Jones

Le Canada a l’occasion de devenir un chef de file mondial de l’élimination du dioxyde de carbone

Températures extrêmes : comment les villes nord-américaines amplifient-elles le changement climatique?

Questions climatiques : rôle de plus en plus important des hauts dirigeants

Transforming the Textile Industry: Apparel Impact Institute in Conversation

Selon un sondage réalisé par l'Institut pour le climat de BMO auprès des chefs d'entreprise, près de la moitié des chefs d'entreprise des États-Unis et du Canada croient que les changements climatique

Un plus grand nombre d’entreprises ont des plans pour lutter contre les changements climatiques en raison de l’importance croissante qu’ils revêtent sur leurs activités : Résultats du sondage

L’électrification constitue une occasion unique dans le cadre de la transition énergétique

Le soutien du secteur de l’énergie dans l’atteinte des objectifs de décarbonisation du Canada

Questions et réponses : comment transformer les défis économiques en possibilités

Trois idées inspirées de la Semaine du climat pour passer à l’action à la COP28

Protecting Outdoor Spaces: The Conservation Alliance in Conversation

Building Meaningful Connections with Nature: Parks California in Conversation

Pourquoi les entreprises doivent accélérer leurs efforts pour lutter contre les changements climatiques

Du caractère essentiel du financement pour doper les technologies d’élimination du carbone

Transformer le système alimentaire mondial au bénéfice des investisseurs et de la planète

BMO Donates $3 Million to GRID Alternatives to Provide Solar Energy Solutions for Low-Income Families

Banco do Brasil and BMO Financial Group to Introduce First-of-its-Kind Program to Provide Sustainability-Linked Trade Loans Supporting Brazilian Exporters

Comment les investissements dans le captage du carbone peuvent générer des crédits carbone

Free, Prior and Informed Consent (FPIC): Mark Podlasly in Conversation

Comment les concessionnaires automobiles contribuent à la transition vers la carboneutralité

Les feux de forêt au Canada brûlent toujours: explications d’experts

BMO fournit un nouveau produit innovant, le dépôt lié à la durabilité, à Zurn Elkay Water Solutions

Quick Listen: Michael Torrance on Empowering Your Organization to Operationalize Sustainability

BMO seule grande banque nommée au palmarès des 50 meilleures entreprises citoyennes au Canada

Quick Listen: Darryl White on the Importance of US-Canada Partnership

Un investissement rentable : la rénovation comme moyen d’atteindre la carboneutralité

Évolution du marché du carbone : ce qu’en pensent les principaux acteurs

BMO et Bell Canada mettent en œuvre un produit dérivé innovant lié à la durabilité et à des objectifs ambitieux de réduction des émissions de gaz à effet de serre

BMO fait partie d'un groupe convoqué par l'ONU qui conseille les banques mondiales sur l'établissement d'objectifs liés à la nature

Les chefs de file de l’investissement intensifient leurs efforts en vue d’atteindre l’objectif net zéro

Favoriser les innovations technologiques pour renforcer la résilience face aux changements climatiques

BMO célèbre le Jour de la Terre avec la 3e édition annuelle du programme Des transactions qui font pousser des arbres dans ses salles des marchés mondiaux

BMO Donates $2 Million to the University of Saskatchewan to Accelerate Research Critical to the Future of Food

Le temps presse pour les solutions au changement climatique - Sommet Canada-États-Unis

North America’s Critical Minerals Advantage: Deep Dive on Community Engagement

Réchauffement climatique : le GIEC lance son dernier avertissement de la décennie

La confiance est la denrée la plus précieuse : Message de l’ICMM à la Conférence mondiale sur les mines, métaux et minéraux critiques de BMO

Exploration des avantages de l’extraction de minéraux critiques en Amérique du Nord dans le cadre de la Conférence mondiale sur les mines, métaux et minéraux critiques

Les légendes du roc réfléchissent aux réussites et aux échecs de l’industrie minière lors de la Conférence mondiale sur les mines, métaux et minéraux critiques

Explorer les risques et les possibilités associés aux notations ESG dans le secteur minier

BMO Experts at our 32nd Global Metals, Mining & Critical Minerals Conference

Evolving Mining for a Sustainable Energy Transition: ICMM CEO Rohitesh Dhawan in Conversation

BMO Equity Research on BMO Radicle and the World of Carbon Credits

Public Policy and the Energy Transition: Howard Learner in Conversation

Taskforce on Nature-Related Financial Disclosure (TNFD) – A Plan for Integrating Nature into Business

Points à retenir du sondage sur le climat des petites et moyennes entreprises réalisé par l’Institut pour le climat de BMO

BMO nommée banque la plus durable d'Amérique du Nord par Corporate Knights pour la quatrième année d'affilée

Le financement vert du nucléaire : nouvelle frontière de la transition énergétique?

ESG Trends in the Base Metal and Diversified Mining Industries: BMO Equity Research Report

Assurer l’avenir des approvisionnements alimentaires : le rôle de l’Amérique du Nord

BMO s'est classé parmi les entreprises les plus durables en Amérique du Nord selon les indices de durabilité Dow Jones

Un sondage de l'Institut pour le climat de BMO révèle que les coûts et les priorités concurrentes ralentissent l'action climatique des petites et moyennes entreprises

Gérer et monétiser votre transition vers un monde carboneutre avec BMO et Radicle

BMO est l'institution financière la mieux classée selon le Global Sustainability Benchmark, le nouvel indice de référence mondial du développement durable annoncé lors de la COP 27

COP27 : Les problèmes de sécurité énergétique et l’incertitude économique ralentiront-t-ils la transition climatique?

BMO investira dans les crédits compensatoires de carbone novateurs de CarbonCure pour stocker du CO₂ de façon permanente

Financement commercial : vers le développement durable, une entreprise à la fois

RoadMap Project: An Indigenous-led Paradigm Shift for Economic Reconciliation

Une première canadienne : BMO et l'Université Concordia s'unissent pour un avenir durable grâce à un prêt innovant lié à la durabilité

On-Farm Carbon and Emissions Management: Opportunities and Challenges

Intégration des facteurs ESG dans les petites et moyennes entreprises : Conférence de Montréal

BMO entend racheter Radicle Group Inc., un chef de file des services environnementaux situé à Calgary

Investment Opportunities for a Net-Zero Economy: A Conversation at the Milken Institute Global Conference

S’ajuster face aux changements climatiques : l’Institut pour le climat de BMO

How Hope, Grit, and a Hospital Network Saved Maverix Private Capital Founder John Ruffolo

Hydrogen’s Role in the Energy Transition: Matt Fairley in Conversation

Les risques physiques et liés à la transition auxquels font face l’alimentation et l’agriculture

Key Takeaways on Ag, Food, Fertilizer & ESG from BMO’s Farm to Market Conference

Building an ESG Business Case in the Food Sector: The Food Institute

Aller de l’avant en matière de transition énergétique : Darryl White s’adresse aux gestionnaires de réserves et d’actifs mondiaux

BMO et EDC annoncent une collaboration pour présenter des solutions de financement durable aux entreprises canadiennes

Financer la transition vers la carboneutralité : une collaboration entre EDC et BMO

Refonte au Canada pour un monde carboneutre : Conversation avec Corey Diamond d’Efficacité énergétique Canada

The Role of Hydrogen in the Energy Transition: FuelCell Energy CEO Jason Few in Conversation

BMO est fier de soutenir la première transaction d'obligations vertes du gouvernement du Canada en tant que cochef de file

Article d’opinion: Le Canada peut être un leader en matière de sécurité énergétique

Tackling Climate Change in Metals and Mining: ICMM CEO Rohitesh Dhawan in Conversation

Les mesures prises par le gouvernement peuvent contribuer à stimuler la construction domiciliaire afin de remédier à la pénurie de logements au Canada

La circulaire de sollicitation de procurations et les rapports sur la durabilité 2021 de BMO sont maintenant disponibles

Why Changing Behaviour is Key to a Low Carbon Future – Dan Barclay

BMO lance le programme Services aux entreprises à portée de main - BMO pour les entrepreneurs noirs et annonce un engagement de 100 millions de dollars en prêts pour aider les entrepreneurs noirs à dé

The Post 2020 Biodiversity Framework – A Discussion with Basile Van Havre

BMO annonce son intention de se joindre au programme Catalyst de Breakthrough Energy pour accélérer l'innovation climatique

BMO Groupe financier nommé banque la plus durable en Amérique du Nord pour la troisième année d'affilée

Using Geospatial Big Data for Climate, Finance and Sustainability

Atténuer les répercussions des changements climatiques sur les actifs physiques par la finance spatiale

Part 2: Talking Energy Transition, Climate Risk & More with Bloomberg’s Patricia Torres

Part 1: Talking Energy Transition, Climate Risk & More with Bloomberg’s Patricia Torres

BMO aide Boralex à aller Au-delà des énergies renouvelables en transformant sa facilité de crédit en un prêt lié au développement durable

The Global Energy Transition: Darryl White & John Graham Discuss

Première mondiale : BMO soutient Bruce Power avec le premier cadre de financement vert du secteur nucléaire au monde

BMO se classe parmi les entreprises les plus durables au monde, selon les indices de durabilité Dow Jones

The Risk of Permafrost Thaw on People, Infrastructure & Our Future Climate

COP26 : Pourquoi les entreprises doivent assumer leur responsabilité sociale

Climate Change & Flood Risk: Implications for Real Estate Markets

The Future of Remote Work and Diversity in the Asset Management Industry

Director of ESG at BMO Talks COP26 & the Changing ESG Landscape

Changer les comportements est essentiel pour assurer un avenir à faible émission de carbone – Table ronde Milken

BMO aide Teck Resources à progresser vers ses objectifs ESG avec un prêt lié à la durabilité

Candidature du Canada pour accueillir le nouveau siège social de l'ISSB

Première dans le secteur des métaux et des mines en Amérique du Nord : BMO aide Sandstorm Gold Royalties à atteindre ses objectifs ESG grâce à un prêt lié à la durabilité

Éducation, emploi et autonomie économique : BMO publie Wîcihitowin ᐑᒋᐦᐃᑐᐏᐣ, son premier Rapport sur les partenariats et les progrès en matière autochtone annuel

Comprendre la Journée nationale de la vérité et de la réconciliation

Comprendre la Journée nationale de la vérité et de la réconciliation

Combler l’écart de richesse entre les groupes raciaux grâce à des actions mesurables

BMO annonce un engagement de financement de 12 milliards de dollars pour le logement abordable au Canada

Investing in Real Estate Sustainability with Bright Power Inc.

In support of Canada’s bid to host the headquarters of the International Sustainability Standards Board

BMO appuie la candidature du Canada pour accueillir le siège du Conseil des normes internationales d'information sur la durabilité

BMO nommé au classement des 50 meilleures entreprises citoyennes au Canada de Corporate Knights

ESG From Farm to Fork: Doing Well by Doing Good

Biggest Trends in Food and Ag, From ESG to Inflation to the Supply Chain

Banques centrales, changements climatiques et leadership : Forum annuel destiné aux femmes œuvrant dans le secteur des titres à revenu fixe, devises et produits de base

L’appétit croissant pour l’investissement dans un but précis dans les valeurs à revenu fixe par Magali Gable

BMO met sur pied une nouvelle équipe innovatrice pour la transition énergétique

Première nord-américaine : BMO aide Gibson Energy à transformer entièrement une facilité de crédit en un prêt lié à la durabilité

Le programme Des transactions qui font pousser des arbres permettra d’en planter 100 000

Understanding Biodiversity Management: Best Practices and Innovation

Les arbres issus des métiers bénéficient d'un marché obligataire ESG solide

The Changing Face of Sustainability: tentree for a Greener Planet

Favoriser des résultats durables : le premier prêt vert offert au Canada

Favoriser l’autonomisation dans une perspective d’équité raciale et de genre

Episode 31: Valuing Natural Capital – A Discussion with Pavan Sukhdev

Episode 29: What 20 Years of ESG Engagement Can Teach Us About the Future

Rapport sur les perspectives de 2021 de BMO Gestion mondiale d'actifs : des jours meilleurs à venir

Episode 28: Bloomberg: Enhancing ESG Disclosure through Data-Driven Solutions

Comment Repérer L’écoblanchiment Et Trouver Un Partenaire Qui Vous Convient

BMO se classe parmi les entreprises les plus durables selon l'indice de durabilité Dow Jones - Amérique du Nord

Episode 27: Preventing The Antimicrobial Resistance Health Crisis

BMO investit dans un avenir durable grâce à un don d’un million de dollars à l’Institute for Sustainable Finance

BMO Groupe financier franchit une étape clé en faisant correspondre 100 pour cent de sa consommation d'électricité avec des énergies renouvelables

BMO Groupe financier reconnu comme l'une des sociétés les mieux gérées de manière durable au monde dans le nouveau classement du Wall Street Journal

Episode 25: Achieving Sustainability In The Food Production System

Episode 23: TC Transcontinental – A Market Leader in Sustainable Packaging

Les possibilités de placement durables dans le monde d’après la pandémie

Les sociétés axées sur l’efficacité énergétique peuvent maintenant réduire leurs coûts d’emprunt

Episode 16: Covid-19 Implications and ESG Funds with Jon Hale

BMO Groupe financier s'approvisionnera à 100 pour cent en électricité à partir d'énergies renouvelables

Episode 13: Faire face à la COVID-19 en optant pour des solutions financières durables

Épisode 09 : Le pouvoir de la collaboration en matière d'investissement ESG

Épisode 08 : La tarification des risques climatiques, avec Bob Litterman

Épisode 07 : Mobiliser les marchés des capitaux en faveur d’une finance durable

Épisode 06 : L’investissement responsable – Tendances et pratiques exemplaires canadiennes

Épisode 04 : Divulgation de renseignements relatifs à la durabilité : Utiliser le modèle de SASB

Épisode 03 : Taxonomie verte: le plan d'action pour un financement durable de l'UE

Épisode 02 : Analyser les risques climatiques pour les marchés financiers